Numbers don’t lie: International commercial arbitration statistics 2023

Full-time arbitrator, James Clanchy FCIArb, discusses the importance of data about arbitrations and the statistics for 2023 released by institutions and other bodies.

As the international arbitration community continues to absorb the aftershocks of Mr Justice Robin Knowles’ searing decision setting aside the award in Nigeria v P&ID [2023] EWHC 2638 (Comm.), it is more important than ever that we have reliable statistical data with which to defend and explain arbitration to others.

Johnny Veeder KC made a call for such data in his Ciarb Alexander Lecture, ‘What Matters – about Arbitration’, in 2015. He was concerned by growing discontent with investor-state arbitration and by arbitration’s ‘over-ambitious promoters’. He memorably said, ‘arbitration cannot do everything’. The demise of arbitration was ‘far from inevitable’ but it had to answer its critics and, for that purpose, comprehensive and user-based statistics were essential.

Data collection in a diverse and private arena: The silo and Woozle effects

The collection of statistics in arbitration is no easy business. By its nature, commercial arbitration is generally private. Institutions publish different caseload statistics at different times, sometimes not at all if they have had a bad year. One institution’s annual report recently covered on its ‘statistics’ page the numbers of marketing initiatives it had carried out in different countries, but it had nothing about numbers of cases. Trade associations are sometimes reluctant to let the outside world know how often their members have disputes with each other.

Innovative and instructive as they are, surveys conducted in the orbits of university law schools and law firms are naturally limited by the experience and horizons of their pools of respondents. This is the silo effect. Information they collate about, for example, their respondents’ preferences for seats or their use of institutional and ad hoc rules is relied upon in articles by academics and lawyers as objective data on the actual use of those seats and rules. Those articles are then cited in others, turning them into factoids. This phenomenon is known as the Woozle effect.

Snapshots from six arbitral bodies 2016 - 2023

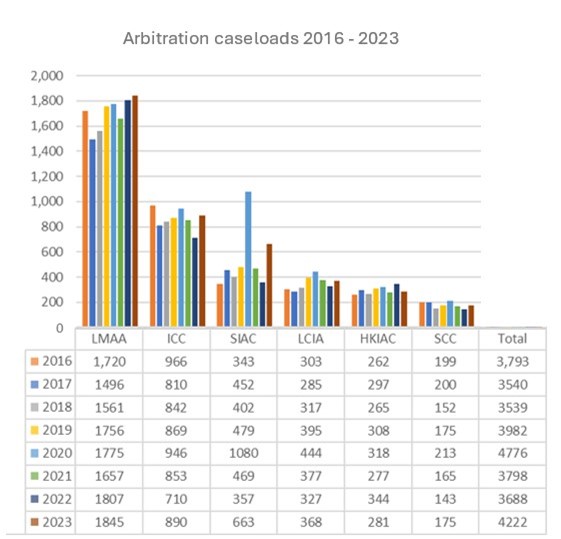

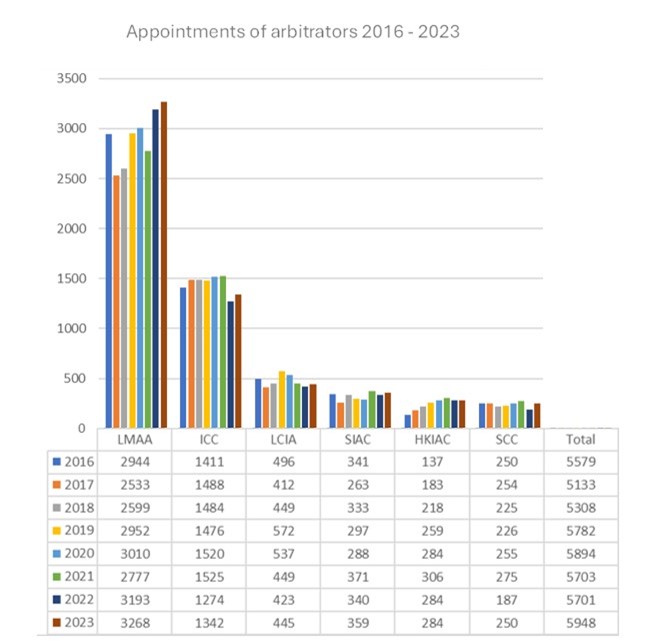

Against this background, LexisNexis, which has been collating arbitration statistics for some years, started publishing its series of statistical analyses of international commercial arbitration in 2018. These are based on snapshots of data published by the five institutions which the respondents to the White & Case Queen Mary International Arbitration Survey 2018 had declared to be their favourites with the addition of the London Maritime Arbitrators Association (LMAA), which publishes rules for use in ad hoc arbitrations but does not administer cases. The updated graphs for the years 2016 to 2023 for numbers of new cases and (of particular interest to Ciarb members) for appointments of arbitrators, are reproduced below.

The highpoint on both counts was in 2020, the year after the outbreak of the global Covid -19 pandemic. As the graphs illustrate, the statistics from these bodies show renewed increases in 2023 with the number of appointments of arbitrators reaching a slightly higher total than in 2020.

Shortly after releasing its caseload numbers for 2023, the International Chamber of Commerce (ICC) published its detailed statistical reports not only for 2023 but also for 2021 and 2022. As is clear from its reports, the range, diversity and international reach of ICC arbitration are unique. The data which the institution collates and publishes is fascinating and instructive. Its numbers of new cases and appointments were both lower in 2023 than they were in 2016, but the institution has made up some lost ground since 2022.

Meanwhile the LMAA saw its highest numbers of both new cases and appointments in 2023. Its caseload is more than twice the size of the ICC’s, illustrating the strength and continuing popularity of ad hoc arbitration, particularly in London. Its 3,268 appointments of arbitrators represent 56% of all the appointments made across the six bodies in 2023.

The 2021 White & Case Queen Mary survey found that Singapore was in joint first place with London as the respondents’ most preferred seat. International arbitration has grown enormously in Singapore in the last 20 years. The Singapore International Arbitration Centre (SIAC) comes out top in terms of caseload growth over the eight years covered in the graphs. Its number of new cases in 2023 (663) was nearly double the number in 2016 (343). Additionally, it saw its second highest number of appointments of arbitrators in 2023 (359) but this was only fractionally higher than 2016’s number (341). The institution saw a substantial shortfall between arbitrations commenced and tribunals appointed, as it has done every year. Its total of 359 appointments is less than 10% of the combined total of the LMAA’s and LCIA’s (3,713).

Shipping, commodities and the ICC exception

One of the major reasons for SIAC’s success is that it has established itself as the arbitral institution of choice for disputes arising from international trade transactions in the Asia-Pacific region. It reports that in 2023, 47% of its disputes related to trade and 13% maritime/shipping, making a total of 60% (400 arbitrations) across these two categories. Construction/Engineering had just 8% (50 arbitrations).

According to the LCIA’s annual casework report for 2023, ‘The ongoing impact of global developments on energy prices and supply chains has contributed to the continued dominance of transport and commodities cases.’ The subject matter of the latter was wide ranging and included liquified natural gas LNG, coal, metals, fertilisers and agricultural products. The institution saw 36% (118) of new cases under its rules (327) in this combined category, on a par with 37% in 2022. However, the LCIA saw fewer cases in these sectors than SIAC. Its docket represents no more than 5% of the shipping and commodities arbitrations seated and/or administered in London in 2023. Apart from the LMAA’s 1,845 estimated new references, Gafta (the Grain and Feed Trade Association) reported 337 new arbitration claims received in the period 1 October 2022 to 30 September 2023, a 29% increase on the previous year. To these should be added new cases submitted to other international trade associations headquartered in London as well as other ad hoc arbitrations. The LCIA’s institutional offering has been and remains a useful addition to the range of options available to parties involved in the sectors which the data shows to be the most productive of arbitrations worldwide.

Hong Kong is another significant hub for shipping and international trade. The Hong Kong International Arbitration Centre (HKIAC) reports that in 2023, 16% of its registered cases concerned maritime disputes and a further 5% international trade/sale of goods. These two categories thus had a combined 21% of the institution’s new cases, making them first equal with corporate disputes and ahead of construction and energy (17.5%).

In contrast, the ICC reports that disputes arising from the construction/engineering and energy sectors ‘which traditionally generate the largest number of ICC cases’ represented over 45% (398) of all new cases registered in 2023 while transportation, metal and raw materials, and general trade and distribution were among the sectors representing 3% to 6% of new cases. Having relatively few arbitrations arising from international commodities and shipping transactions and focussing instead on projects disputes, notably in the energy and construction sectors, the ICC’s caseload is similar to, but much bigger than, the international caseload (97 cases in 2023) of the Stockholm Chamber of Commerce (SCC). The SCC reports that the contracts from which the largest numbers of arbitrations stemmed were service agreements and business acquisition agreements.

Its relatively small proportion of arbitrations arising from international commerce (buying, selling and transporting goods across borders) makes the ICC’s caseload exceptional. Other factors which make it stand out include the high proportion of arbitrations between parties of the same nationality (29%), the number of different cities where arbitrations were seated (116), the number of different laws chosen to govern the contracts in dispute (112), and the number of different arbitrators appointed (935, which exceeded the number of new cases filed). With so many different contracts, seats, and laws at play, it is hardly surprising that so many different arbitrators are appointed in ICC arbitrations.

Although it is exceptional in these and other respects, the ICC finds itself treated as a paradigm or gold standard in international arbitration. The data which confirms its virtual absence from the markets which are the most productive of international arbitrations and its high instances of one-off contracts and one-off disputes must call this status into question.

Conclusion

The 2023 statistics and the release of the ICC’s detailed reports for 2021 and 2022 give much food for thought. The major institutions are making efforts to speed up and simplify their processes but they and new entrants, as well as the arbitration media, professional organisations, university law schools, and practitioners could usefully pay more attention to the rules and practices more frequently used by the sectors which are the most productive of international commercial arbitrations, namely shipping and commodities.

A longer version of this article was published by LexisNexis UK on 24 July 2024 on its research and legal analysis blog and may be found here.